Payments Plus is a versatile digital wallet that allows users to manage their funds easily and securely. Whether you’re using it for everyday purchases, bill payments, or sending money to friends and family, it’s crucial to know how to add money to your Payments Plus account. Here’s a comprehensive guide on how to fund your Payments Plus wallet and make the most out of its features.

Supported Methods for Adding Money to Payments Plus

Here’s a look at the different ways you can add funds to your Payments Plus account, making it easy to manage and access your money.

1. Linking a Bank Account

One of the most convenient ways to add funds to your Payments Plus account is by linking a bank account. Here’s how to do it:

- Open the Payments Plus app or website.

- Navigate to the “Add Money” section.

- Choose the “Bank Account” option.

- Follow the prompts to link your bank account securely. You may need to provide your account number and routing number.

- Once linked, you can transfer funds directly from your bank to Payments Plus, typically within 1-2 business days.

Note: Ensure your bank supports ACH transfers for smooth transactions.

2. Adding Funds via Debit or Credit Card

If you prefer a quicker method, adding funds using a debit or credit card is simple:

- Open the Payments Plus app.

- Select “Add Money” and choose “Debit/Credit Card.”

- Enter your card details (card number, expiration date, and CVV).

- Select the amount you want to add and confirm the transaction.

This method typically processes instantly, but some cards may have associated fees or daily limits for loading money.

3. Direct Deposit

You can set up direct deposit with your employer or government agencies to automatically fund your Payments Plus account:

- To find your Payments Plus account details, go to the “Direct Deposit” section in your app.

- Copy your account number and routing number.

- Provide these details to your employer or benefits provider.

- Your paycheck or benefits will be directly deposited into your Payments Plus account.

Direct deposits are usually available within 1-2 business days of your payday, offering a hands-off way to fund your wallet.

4. Using a Reload Location

If you prefer a more physical method, Payments Plus partners with several retail locations where you can reload your account. Some popular options include convenience stores and supermarkets. Here’s how to do it:

- Find a supported reload location near you.

- Bring your Payments Plus card or account details to the cashier.

- Provide cash or use another payment method to add funds to your account.

- The funds will be instantly added to your Payments Plus wallet.

Note: Reload locations may charge a small fee depending on the store.

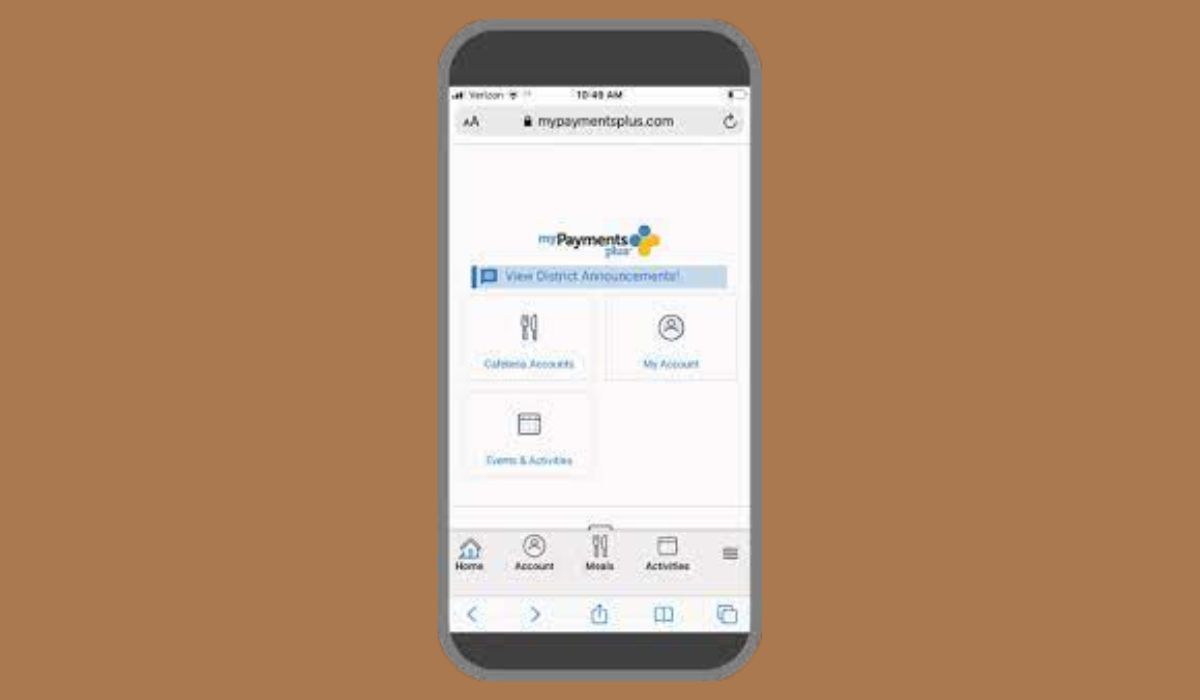

How to Add Money to Payments Plus on Your Phone

If you’re using the Payments Plus app on your smartphone, here’s a simple guide to adding funds:

- Open the Payments Plus app.

- Navigate to the “Add Money” section.

- Choose from available funding options (bank account, debit/credit card, or reload location).

- Follow the on-screen prompts to complete your deposit.

The app’s interface is user-friendly, making it easy to manage your funds on the go. For card or bank transfers, make sure you have a stable internet connection to avoid interruptions during the process.

How Long Does It Take to Add Money to Payments Plus?

The time it takes to add money to your Payments Plus account depends on the method you choose:

- Bank Transfer: Typically takes 1-2 business days.

- Debit/Credit Card: Instant, unless your card issuer has restrictions or delays.

- Direct Deposit: Usually arrives on your payday, but can take 1-2 business days to process.

- Reload Locations: Funds are added instantly after payment.

Keep in mind that each method may have its own transaction limits, so check the app for updates on deposit limits and processing times.

Common Issues When Adding Money to Payments Plus and How to Fix Them

Here are some common issues you might encounter when adding money to your Payments Plus account, along with simple solutions to resolve them:

- Payment Failure: If your payment doesn’t go through, double-check the information you entered, such as your card details or bank account information. Ensure your bank or card issuer allows third-party transactions.

- Deposit Delays: If your bank transfer or direct deposit is delayed, contact your bank or employer to check the status. Sometimes, banking systems experience temporary issues that may cause a delay.

- Reload Location Issues: If you are unable to add funds at a retail location, make sure the store is a supported reload partner. Contact Payments Plus support for a list of locations.

Tips to Manage and Optimize Your Payments Plus Account

To get the most out of your Payments Plus account, here are some practical tips for managing and optimizing your balance and transactions:

- Set Up Automatic Top-Ups: To ensure you never run out of funds, set up an automatic top-up from your linked bank account or card.

- Monitor Your Balance: Regularly check your balance to avoid unexpected declines or payment issues. The app provides real-time balance updates.

- Keep an Eye on Fees: While adding money to Payments Plus is free in most cases, some methods (like reload locations or certain debit cards) may incur fees. Be sure to check for any charges.

Is It Safe to Add Money to Payments Plus?

Yes, adding money to your Payments Plus account is secure. The app uses encryption and other security measures to protect your personal and financial information. To keep your account safe, follow these best practices:

- Use Strong Passwords: Choose a strong and unique password for your Payments Plus account.

- Enable Two-Factor Authentication: Enable 2FA for an added layer of security when accessing your account.

- Monitor Your Account: Regularly check your account for unauthorized transactions and report any suspicious activity immediately.

Conclusion: Get the Most Out of Your Payments Plus Account

Adding money to your Payments Plus account is simple and offers multiple options for convenience. Whether you’re using a bank transfer, debit card, or even a retail reload location, there’s a method that suits your needs. To ensure smooth transactions, stay on top of your deposits and monitor your balance. Remember, Payments Plus is a safe and secure platform, so take advantage of its features to manage your funds effectively.