How Does Venmo Make Money? Understanding Venmo’s Business Model

5 min read

Venmo has become one of the most popular peer-to-peer payment platforms in the world. Used for everything from splitting bills with friends to purchasing goods from merchants, Venmo’s seamless integration with social features and its ability to quickly transfer funds has made it an essential tool for millions. But how does Venmo actually make money? Let’s dive into the different ways this app generates revenue.

How Does Venmo Generate Revenue?

Venmo, like many other apps in the digital payments industry, has a business model that revolves around making money from its users’ transactions. The primary revenue streams for Venmo include transaction fees, premium services, and partnerships with merchants.

Venmo’s revenue structure is relatively simple. While users can send money to friends and family for free, there are specific situations where Venmo charges fees, especially when users are transferring funds instantly or making payments to businesses.

Venmo Transaction Fees: Personal and Business Transfers

One of Venmo’s primary sources of revenue comes from transaction fees. For personal transactions, users can send money to friends and family without incurring any fees, as long as the transfer is made using a bank account, debit card, or Venmo balance.

However, there are fees for certain types of transactions. When you use a credit card to make a payment, Venmo charges a 3% fee. This is how the platform generates income when users choose to use a credit card instead of a linked bank account or debit card.

For business transactions, Venmo charges a 1.9% + $0.10 fee for payments made to merchants. This fee is applied when you pay a business using Venmo, making it a significant revenue stream for the platform.

These transaction fees are a direct source of income for Venmo, contributing significantly to its overall revenue.

Instant Transfer Fees and Other Premium Services

Venmo also offers premium features like instant transfers. While standard transfers to your bank account take 1-3 business days, Venmo offers users the option to make an instant transfer for a fee of 1% of the total amount (with a $0.25 minimum fee).

This instant transfer option is popular for users who need quick access to their money.

In addition, Venmo offers a “Venmo Card” that functions like a debit card, allowing users to spend their Venmo balance anywhere Mastercard is accepted. Venmo charges a small fee for some transactions made with the card, like ATM withdrawals.

These premium features help Venmo monetize beyond its basic peer-to-peer payment service, making the platform profitable for both casual users and those who need additional services.

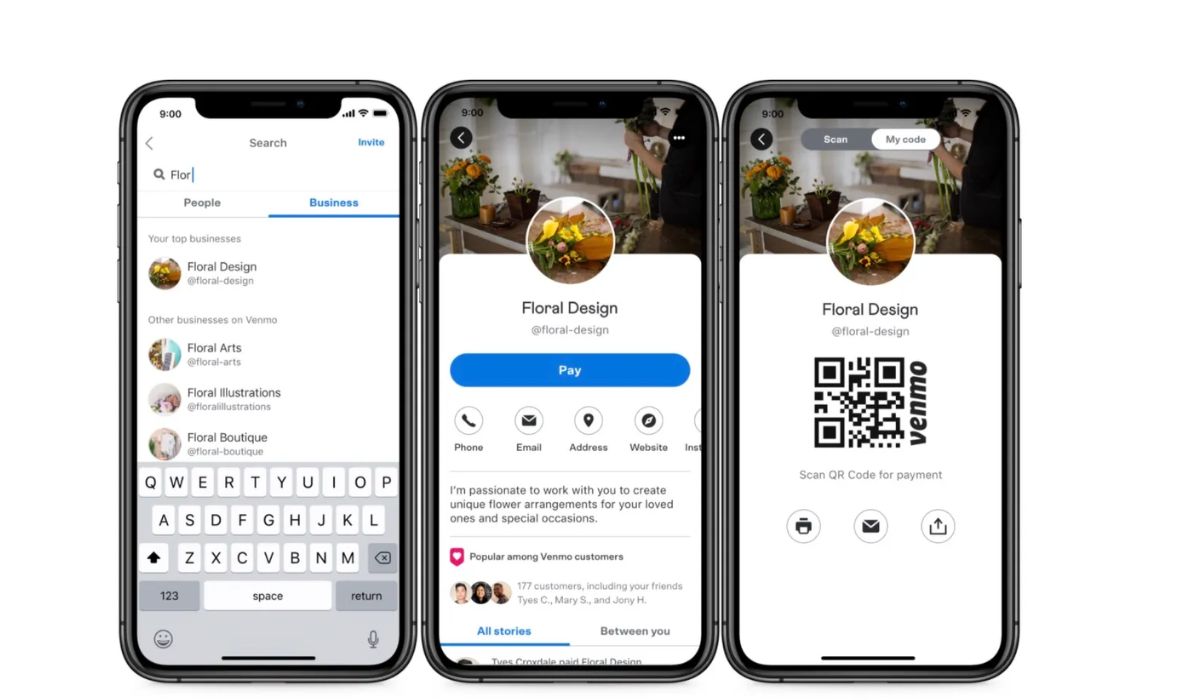

Venmo’s Business Account Fees

Venmo has become increasingly popular with small businesses and freelancers. To cater to this demand, Venmo offers business accounts that allow merchants to accept payments via the platform. As mentioned earlier, business transactions come with a 1.9% + $0.10 fee per transaction.

For businesses that want to accept payments on Venmo, there’s also an option to advertise and promote products directly on the app, potentially opening up a new stream of revenue for the platform.

This business model benefits both Venmo and merchants, as Venmo gets a percentage of every payment made while helping businesses streamline their payment systems by offering a popular digital wallet option.

Venmo’s Social Features and Their Role in Revenue Generation

What sets Venmo apart from other payment platforms is its social feed. The platform allows users to share payment activity and even add messages and emojis to payments, making it a social experience.

While the social feed is mainly designed to enhance user engagement, it also creates opportunities for monetization.

By integrating social features, Venmo can encourage more transactions and increase the chances that users will make payments for goods or services using Venmo rather than other methods.

This social aspect also makes Venmo a platform for businesses to interact with customers directly, whether through ads or special offers. It’s a subtle but effective way of keeping users engaged while generating additional revenue.

Venmo’s Parent Company: PayPal and Its Influence

Venmo is owned by PayPal, one of the largest digital payment companies globally. PayPal’s acquisition of Venmo has allowed the platform to benefit from PayPal’s extensive financial resources, technology, and partnerships.

PayPal’s integration with Venmo has opened up opportunities to expand its user base. Venmo’s success in the peer-to-peer payment space complements PayPal’s broader strategy of providing easy and secure payment solutions to users worldwide.

Venmo’s integration with PayPal means that both platforms can benefit from each other’s growth, allowing Venmo to leverage PayPal’s vast network of merchants and users to further boost its revenue.

How Venmo Competes in the Digital Payments Ecosystem

Venmo isn’t the only peer-to-peer payment platform out there. Apps like Zelle, Cash App, and Google Pay all provide similar services. Venmo’s key differentiator is its social element, which encourages users to share their transactions and connect with friends. This makes Venmo more appealing, especially to younger generations who prioritize seamless social interactions alongside financial transactions.

By maintaining a user-friendly interface and offering attractive features, Venmo has managed to stay competitive in an increasingly crowded market, generating a steady stream of revenue through fees and partnerships.

Future Strategies to Increase Venmo’s Revenue

As Venmo continues to grow, it may explore additional ways to increase its revenue. Future opportunities could include expanding its business offerings, introducing new premium services, or increasing its role in online commerce.

Venmo’s parent company, PayPal, has a track record of integrating new payment technologies, and it’s likely that Venmo will continue to evolve and adapt to changing market demands, increasing its monetization capabilities in the process.

Conclusion

Venmo’s business model is built around several key revenue streams, including transaction fees, instant transfer services, and merchant fees. By combining peer-to-peer payments with social features, Venmo has found a way to generate consistent revenue while keeping users engaged.

Looking forward, Venmo’s partnership with PayPal and its growing presence in the digital payment ecosystem suggests that the platform will continue to expand and evolve, finding new ways to monetize its services in the future.