Can a Non-Frequent Traveler Benefit from Amex Platinum?

5 min read

The American Express Platinum card is widely recognized for its travel perks, but what if you don’t fly often? Can non-frequent travelers still get value from it? The short answer is yes—this card provides benefits beyond flights and hotels, making it useful even if you only travel occasionally.

From airport lounge access and airline credits to dining privileges and insurance coverage, Amex Platinum offers perks that enhance both travel and everyday life. But is it worth the high annual fee? Let’s break down whether the card makes sense for someone who isn’t constantly on the move.

What is the Amex Platinum Card?

The American Express Platinum is a premium credit card designed for people who enjoy luxury travel, exclusive experiences, and premium lifestyle benefits. While it’s often marketed to frequent travelers, it also provides high-value statement credits, airport perks, insurance protections, and dining privileges, which can be useful even for those who travel just a few times per year.

This card comes with Membership Rewards Points, which can be used for flights, hotels, upgrades, or transferred to airline partners. But even if you’re not flying often, you can still maximize these rewards on select dining and lifestyle purchases.

Why Amex Platinum is Still Worth It for Non-Frequent Travelers

Even if you don’t travel every month, the Amex Platinum card still offers strong benefits. Some of the most valuable perks include:

- Annual travel credit – Can be redeemed for flights, hotels, or car rentals.

- Airport lounge access – Over 1,400 airport lounges worldwide make trips more comfortable.

- Airline points transfers – Convert Membership Rewards points to major airline loyalty programs.

- Dining benefits – VIP reservations, exclusive restaurant access, and dining credits.

- Comprehensive insurance – Strong travel and purchase protection, even for occasional travelers.

- Global Entry/TSA PreCheck – Statement credit covers the cost of application fees.

Even if you only take a few trips a year, these perks can make your travel more comfortable, affordable, and rewarding.

Travel Benefits That Make Amex Platinum Useful

Here are the key benefits that make Amex Platinum valuable even for non-frequent travelers.

Annual Travel Credit

Each year, Amex Platinum provides a statement credit that can be applied to flights, hotels, or car rentals. Even if you’re not a frequent traveler, this perk alone can offset a large portion of the annual fee.

Airport Lounge Access

One of the standout features of this card is access to over 1,400 airport lounges worldwide. Even if you only fly a few times per year, being able to relax in Centurion Lounges, Priority Pass lounges, and Delta Sky Clubs can significantly improve your travel experience.

Airline Points Transfers & International Airline Program

With Amex Platinum, you can transfer Membership Rewards Points to frequent flyer programs from leading airlines, including Delta, British Airways, and Singapore Airlines. Even if you don’t travel frequently, this gives you flexibility when booking flights.

Additionally, the International Airline Program helps you save on select first-class and business-class flights with top airlines, making occasional luxury travel more affordable.

Non-Travel Perks That Add Value

Here are the top non-travel perks that add value to the Amex Platinum card.

Dining Privileges & VIP Reservations

American Express Platinum offers Global Dining Access by Resy, which gives VIP status at top restaurants. Even if you aren’t traveling, this perk allows you to get exclusive reservations, priority seating, and access to high-end dining experiences.

Additionally, cardholders receive dining statement credits that can be applied to Uber Eats, select restaurants, and premium food delivery services.

Comprehensive Insurance Coverage

The card includes purchase protection, extended warranties, and travel insurance, making it useful even if you don’t fly often. Coverage includes:

- Trip cancellation insurance – Protects against unexpected cancellations.

- Baggage insurance – Covers lost, stolen, or delayed luggage.

- Purchase protection – Safeguards eligible purchases from damage or theft.

- Extended warranty – Adds an additional year to eligible manufacturer warranties.

Global Entry & TSA PreCheck Reimbursement

Even if you only take a few trips per year, having Global Entry or TSA PreCheck can save you time at the airport. Amex Platinum covers the full application fee for these programs, making your occasional trips smoother and faster.

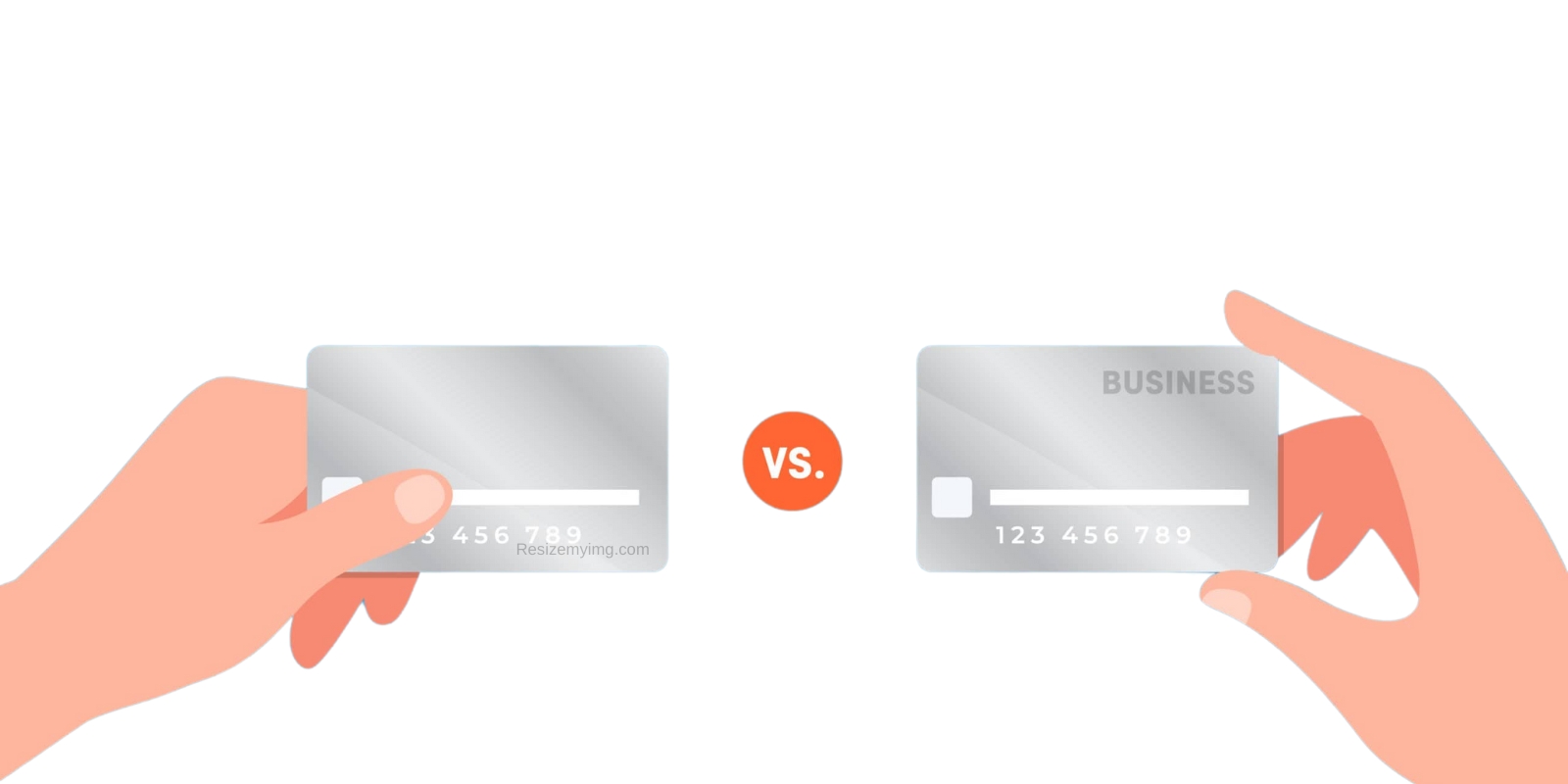

Comparing Amex Platinum to Other Premium Cards for Non-Travelers

While Amex Platinum offers a lot, how does it compare to other high-end credit cards that might be better suited for non-travelers?

| Feature | Amex Platinum | Chase Sapphire Reserve | Capital One Venture X |

| Annual Fee | $695 | $550 | $395 |

| Travel Credit | Flights, hotels, car rentals | Hotels, travel purchases | Travel purchases |

| Lounge Access | 1,400+ lounges | Priority Pass | Priority Pass |

| Dining Perks | VIP reservations, statement credits | DoorDash, Instacart credits | Limited dining benefits |

| Purchase Protection | Strong | Moderate | Limited |

| Best For | Luxury travelers & lifestyle perks | Balanced rewards | Lower annual fee alternative |

If you don’t travel often but enjoy dining, shopping, and lifestyle perks, the Amex Platinum might be the best choice. However, if you’re looking for a lower fee and more flexible rewards, alternatives like Chase Sapphire Reserve or Capital One Venture X may be worth considering.

Who Should Get Amex Platinum Even Without Frequent Travel?

This card makes sense if you:

- Take a few high-end trips per year and want luxury benefits.

- Enjoy premium dining experiences and VIP restaurant access.

- Use Uber Eats or other premium food delivery services.

- Want strong shopping protections and extended warranties.

- Value concierge services for reservations, event tickets, and travel planning.

Even if you don’t travel every month, the benefits can still make up for the cost if you use them strategically.

When Amex Platinum Might NOT Be Worth It

Despite its perks, Amex Platinum isn’t for everyone. You might want to skip it if:

- You don’t use statement credits for travel, dining, or shopping.

- You prefer cashback over travel rewards.

- You don’t value luxury experiences like VIP dining or premium shopping perks.

- You rarely fly and don’t use airport lounges.

If most of the perks would go unused, a different card with a lower annual fee and cashback rewards might be a better fit.

Final Verdict: Should a Non-Frequent Traveler Get Amex Platinum?

Amex Platinum is often seen as a travel-focused card, but it also offers a wide range of luxury perks beyond flights and hotels. Even if you don’t travel often, its statement credits, dining benefits, shopping perks, and premium services can still justify the cost.

However, if you don’t maximize these benefits, a different card may offer better value. Before applying, think about how often you would use the lounge access, dining perks, and travel credits—if these align with your lifestyle, Amex Platinum could still be worth it.

Would you consider getting Amex Platinum for its non-travel benefits? Share your thoughts in the comments!